For detail information about the Quantiative Fair Value Estimate, please visit here Past performance of a security may or may not be sustained in future and is no indication of future performance. Investments in securities are subject to market and other risks. It is a projection/opinion and not a statement of fact. The Quantitative Fair Value Estimate is calculated daily. The Quantitative Fair Value Estimate is based on a statistical model derived from the Fair Value Estimate Morningstar’s equity analysts assign to companies which includes a financial forecast of the company. Quantitative Fair Value Estimate represents Morningstar’s estimate of the per share dollar amount that a company’s equity is worth today. For detail information about the Morningstar Star Rating for Stocks, please visit here If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. A 5-star represents a belief that the stock is a good value at its current price a 1-star stock isn't. This process culminates in a single-point star rating that is updated daily. Four components drive the Star Rating: (1) our assessment of the firm’s economic moat, (2) our estimate of the stock’s fair value, (3) our uncertainty around that fair value estimate and (4) the current market price. Morningstar assigns star ratings based on an analyst’s estimate of a stock's fair value. It is projection/opinion and not a statement of fact. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. The stock market rally since October hasn’t fazed tactical allocation funds - they have kept movi. The bank doesn't get as much attention as the "big five," which can lead to opportunities for inv. AI will increase productivity, but it won’t happen overnight, and don’t expect miracles. Is Artificial Intelligence Coming for Your Job?.Reducing the weight of the 'Magnificent Seven' in the index (and QQQ) might not be a case of 'Mar. Does the Special Rebalance of Nasdaq 100 Amount to Market Timing?.MOST READ: The most expensive stock in Canada, paying down a mortgage, and home country bias were. If a buyback is done at the expense of running a business, it's a bad one.

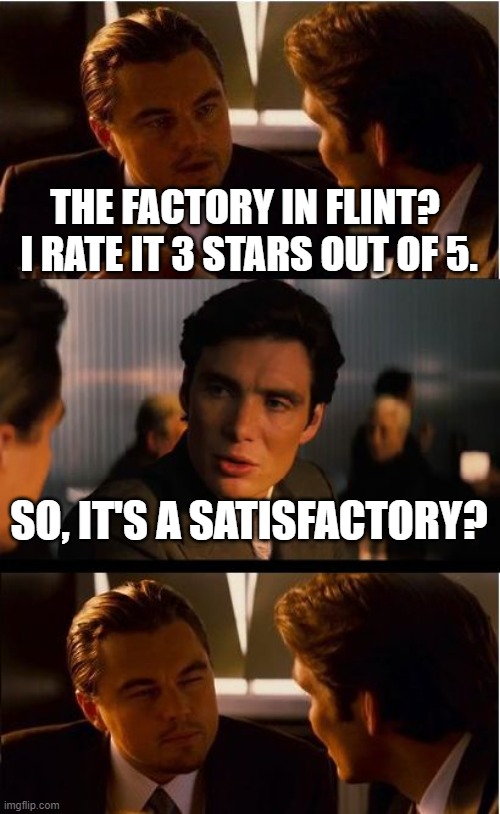

#I rate it minus 5 stars how to#

How to Tell a Good Stock Buyback From a Bad One.The Morningstar Rating for Funds, often called the Star Rating, is a data-driven rating that m.

The Morningstar Fair Value Estimate tells investors what the long-term intrinsic value of a st. The Morningstar Rating for stocks can help investors uncover stocks that are truly undervalued. The Morningstar Economic Moat Rating represents a company's sustainable competitive advantage.

0 kommentar(er)

0 kommentar(er)